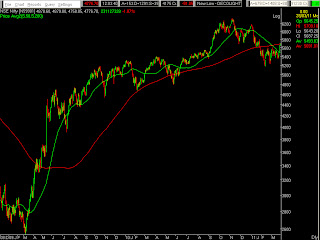

3rd October 2011,Monday

Jul 6, 2009: The Sensex ended with a loss of 869 points at 14,043 following the Union Budget announced this afternoon. The index had opened in the green and gained 184 points to touch a high of 15,098. However, the Union Budget did not go down well with the investors and the Sensex started slipping in noon trades. Thereafter the index crashed to a low of 13,959 - down 1,139 points from the day's high.

Jan 22, 2008: The Sensex saw its biggest intra-day fall on Tuesday when it hit a low of 15,332, down 2,273 points. However, it recovered losses and closed at a loss of 875 points at 16,730. The Nifty closed at 4,899 at a loss of 310 points. Trading was suspended for one hour at the Bombay Stock Exchange after the benchmark Sensex crashed to a low of 15,576.30 within minutes of opening, crossing the circuit limit of 10%.

Jan 21, 2008: The Sensex saw its highest ever loss of 1,408 points at the end of the session on Monday. The Sensex recovered to close at 17,605.40 after it tumbled to the day's low of 16,963.96, on high volatility as investors panicked following weak global cues amid fears of the US recession.

January 18, 2008: Unabated selling in the last one hour of trade saw the index tumble to a low of 18,930 - down 786 points from the day's high. The Sensex finally ended with a hefty loss of 687 points (3.5%) at 19,014. The index thus shed 8.7% (1,813 points) during the week. The NSE Nifty plunged 3.5% (208 points) to 5,705.

December 17, 2007: A heavy bout of selling in the late noon deals saw the index plunge to a low of 19,177 - down 856 points from the day's open. The Sensex finally ended with a huge loss of 769 points (3.8%) at 19,261. The NSE Nifty ended at 5,777, down 271 points.

November 21, 2007: Mirroring weakness in other Asian markets, the Sensex saw relentless selling. The index tumbled to a low of 18,515 - down 766 points from the previous close. The Sensex finally ended with a loss of 678 points at 18,603. The Nifty lost 220 points to close at 5,561.

October 18, 2007: Profit-taking in noon trades saw the index pare gains and slip into negative zone. The intensity of selling increased towards the closing bell, and the index tumbled all the way to a low of 17,771 - down 1,428 points from the day's high. The Sensex finally ended with a hefty loss of 717 points (3.8%) at 17,998. The Nifty lost 208 points to close at 5,351.

August 16, 2007: The Sensex, after languishing over 500 points lower for most of the trading sesion, slipped again towards the close to a low of 14,345. The index finally ended with a hefty loss of 643 points at 14,358.

August 01, 2007: The Sensex opened with a negative gap of 207 points at 15,344 amid weak trends in the global market and slipped deeper into the red. Unabated selling across-the-board saw the index tumble to a low of 14,911. The Sensex finally ended with a hefty loss of 615 points at 14,936. The NSE Nifty ended at 4,346, down 183 points. This is the third biggest loss in absolute terms for the index.

April 02, 2007: The Sensex opened with a huge negative gap of 260 points at 12,812 following the Reserve Bank of India decision to hike the cash reserve ratio and repo rate. Unabated selling, mainly in auto and banking stocks, saw the index drift to lower levels as the day progressed. The index tumbled to a low of 12,426 before finally settling with a hefty loss of 617 points (4.7%) at 12,455.

May 18, 2006: The Sensex registered a fall of 826 points (6.76%) to close at 11,391, following heavy selling by FIIs, retail investors and a weakness in global markets. The Nifty crashed by 496.50 points (8.70%) points to close at 5,208.80 points